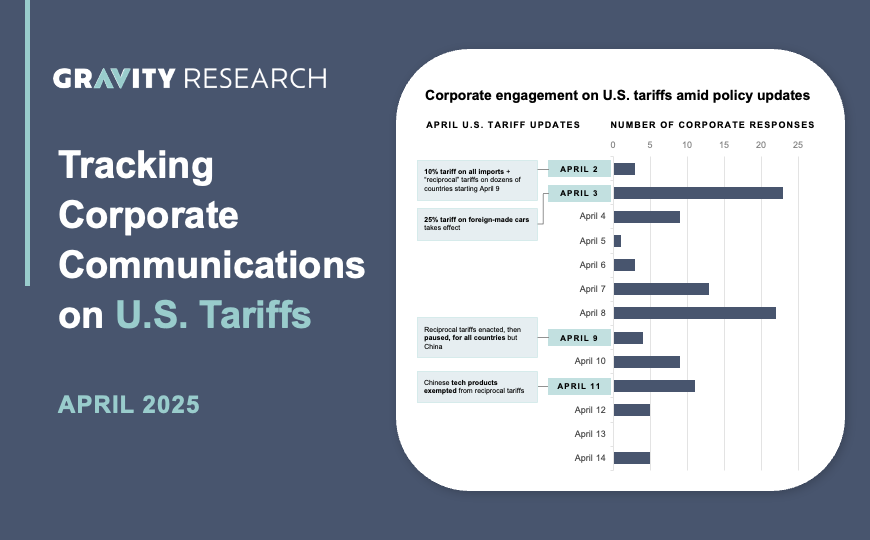

As the Trump administration introduces sweeping global tariffs, droves of companies are rapidly responding. From April 2 to 14, 2025, Gravity Research tracked and analyzed over 100 public statements from more than 90 domestic and international companies navigating this shifting trade environment. Our latest benchmarking report sheds light on how leading brands are communicating around mounting supply chain challenges, consumer concerns, and economic uncertainty.

Key Takeaways

Consumer brands are leading the charge

Nearly half of all tracked statements came from consumer discretionary and staples companies–sectors with unique exposure to international supply chain risks and price-sensitive shoppers. These companies are under increasing pressure as they consider price increases, operational changes, and competing stakeholder expectations.

Cost-cutting and domestic investments emerge as key strategies

46% of statements cited plans to mitigate tariff impacts via operational changes, such as cutting excess costs or diversifying supply chains. While 30% warned of downstream consumer impacts, another 30% explored onshoring or increasing investments in U.S. infrastructure to buffer against tariff risks.

Corporate messaging varies widely by region and ownership

Domestic and foreign-headquartered companies took varied approaches, even within the same industries. While some corporations leaned into opportunistic messaging about supply chain resilience, others struck a more cautious tone, emphasizing the volatility of the economic outlook.

Looking Ahead

As trade tensions prolong, companies must carefully calibrate how they communicate both risk and resilience. The diversity of corporate responses underscores the need for tailored benchmarking and close monitoring of potential reputational risk areas.

Gravity Research helps corporations stay ahead of shifting stakeholder expectations.

Download the report to learn how peer companies are navigating the new tariff landscape.