Rising tariff costs aren’t just a financial challenge—they’re a reputational risk. As U.S. companies weather the implications of evolving tariff policy, they also risk pressure and scrutiny over increased prices. As part of Gravity Research’s expanding Economic Headwinds work in tracking how economic conditions impact corporate reputations, this report explores how corporations are talking about tariff-driven pricing and how poor economic outlooks could add to their reputational exposure.

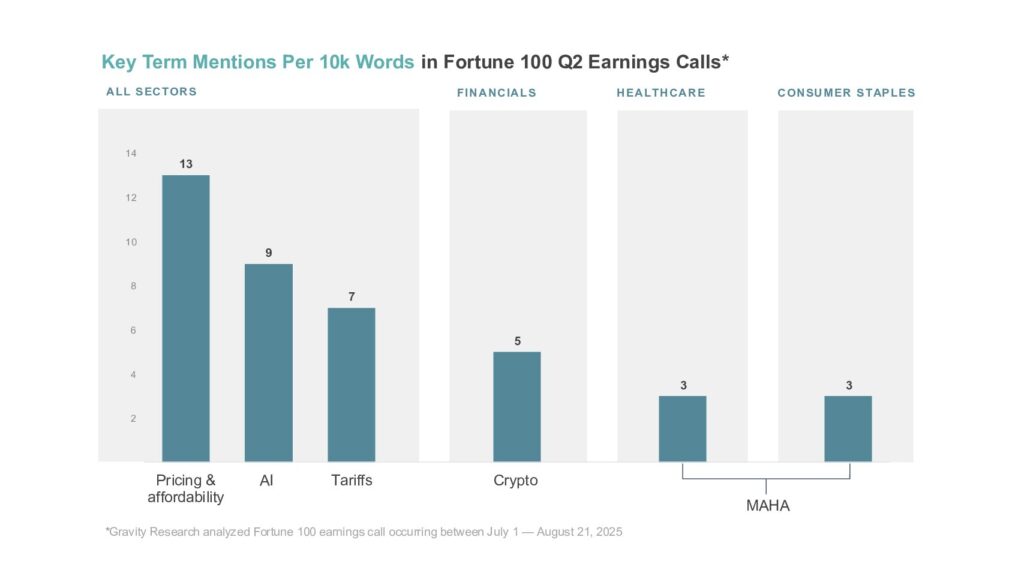

We analyzed Q1 2025 earnings calls from Fortune 100 companies from April 1 to May 22 to assess how executives addressed tariff-related pricing and how often analysts pressed for clarity.

Key Takeaways

Consumer mistrust is on the rise

Public frustration with inflation remains high, and new U.S. tariffs are reviving fears of another wave of price hikes. Consumer sentiment reached near-historic lows in April, a trend that could continue once tariff price effects set in.

Political scrutiny is adding to the pressure

The Trump administration has been quick to criticize companies over price increases tied to tariffs—labeling the moves as “political attacks” and urging brands to “eat the tariffs.” Companies that publicly attribute rising costs to tariffs could face further call-outs, especially if the cost hikes are deemed politically motivated or profit-driven.

Limited corporate engagement on tariff pricing

Our tracking found that less than 20% of Fortune 100 companies discussed tariff pricing in Q1 earnings calls, with most coming from the consumer staples sector. Some executives took a cautious tone, while others signaled pricing changes more directly, reflecting mixed strategies amid growing pressure.

Looking Ahead

As tariff pauses lift and summer spending increases, companies will face growing pressure to address pricing decisions. Consumer backlash surrounding price misinformation and CEO pay rates could also amplify risk.

Gravity Research helps corporate leaders manage the reputational implications of economic uncertainty. Download the full report to learn how peers are approaching tariff-era pricing risk.