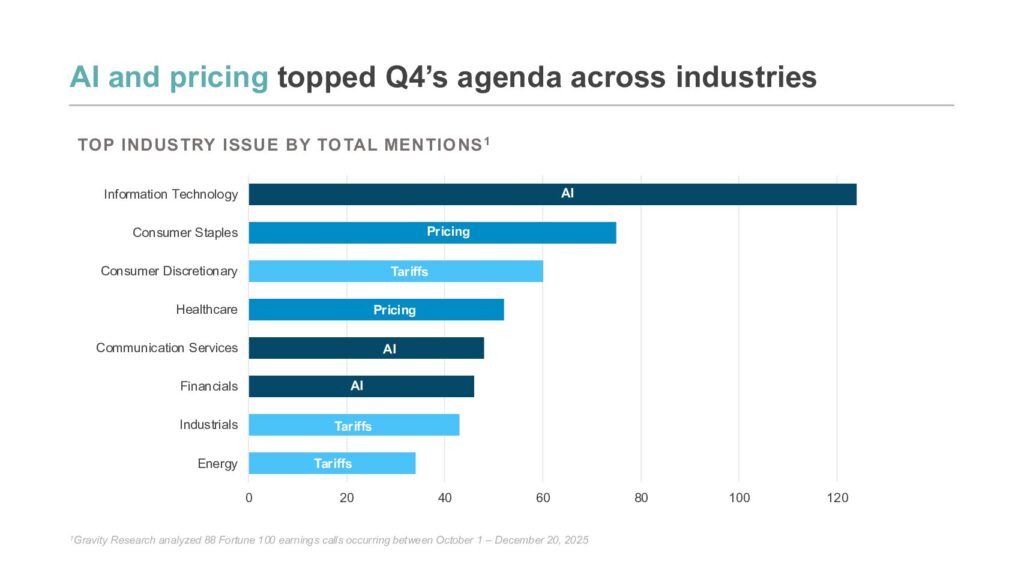

AI investment skepticism, affordability pressures, and climate regulatory conflicts converged in Q4 as corporations navigated intensified stakeholder scrutiny across technology spending, pricing strategies, and environmental commitments.

Gravity Research’s latest Risk Index quantifies reputational risk across societal issues each quarter, tracking corporate engagement, backlash, legislation, and polarization to help decision-makers anticipate pressure and navigate evolving landscapes.

Key Takeaways from Q4

AI “bubble” warnings fueled investor skepticism of corporate spending. Investor demands for tangible ROI on AI partnerships intensified amid widespread speculation, while Trump administration challenges to state AI laws created regulatory uncertainty. Corporations face mounting pressure to independently demonstrate responsible AI development as political focus on data centers threatens midterm entanglement.

The affordability crisis dominated political discourse and intensified anti-corporate sentiment. A record-length government shutdown and high-profile layoffs compounded economic uncertainty, while consumer backlash over perceived high prices on groceries, gas, and everyday goods shaped off-cycle election coverage and heightened scrutiny of corporate pricing strategies.

Climate regulatory tensions drove coalition-based corporate engagement. Sustained conflict between U.S. and European lawmakers over climate reporting requirements led corporations to engage through coalitions when lobbying against EU and California regulations. Individual companies avoided publicly responding to GOP probes, as sustained polarization continues to dissuade visible corporate stances on climate policy.

What to Watch in Q1

AI investment pressures could intensify as media speculation of an “AI bubble” fuels consumer and policymaker scrutiny of corporate partnerships, with upcoming midterms likely driving discussions of AI’s impacts on utility costs, workforce inclusion, and climate. Federal DEI scrutiny may resurge as EEOC investigations resume in 2026, prompting corporations to audit existing inclusion program materials amid anticipated whistleblower complaints.

Download the full report to understand how AI skepticism, affordability pressures, and regulatory conflicts will shape corporate risk in Q1 2026.